A contractor’s affidavit provides reassurance to the project owner that all contractors and vendors on the project have been paid for the work they provided. By signing the form, the contractor swears that payment has been made to everyone working on the project, except those listed on the affidavit.

In some states, an affidavit is required to be sent to the owner before a lien or lawsuit can be filed. Contractors need to be aware of this to ensure that their lien and payment rights are protected.

We’re going to look at what a contractor’s affidavit is, when it’s required, and the difference between an affidavit and a sworn statement. Plus, you can see a sample of a general contractor's affidavit made by a construction attorney.

Table of contents

A contractor’s affidavit, also called a contractor’s final payment affidavit, is a form that lists vendors or subcontractors who are still owed money on a project. It is completed and signed by the general contractor or a subcontractor, notarized, and includes a list of vendors or subcontractors and how much each one is owed on the project.

The contractor signs the form swearing that all suppliers and contractors have been paid for the project, except the ones listed on the affidavit. This reassures the owner and financing company that all other vendors on the project have been paid in full.

In some states, the contractor’s affidavit is required to be sent to the owner before filing a lien or a lawsuit for nonpayment. This lets the project owner know which parties are owed.

Banks or financing companies may also request a contractor’s affidavit from the general contractor on a project before releasing the final payment. They want to be assured that they know who was on the project and who is owed money before releasing the final retention payment.

In some states, a contractor’s affidavit must be sent before filing a lien or a lawsuit for nonpayment. For example, Florida requires an affidavit to be sent to the owner five days before filing a lien or lawsuit. This gives the owner time to make the outstanding payment before a lien or lawsuit is filed.

Contractors may also be required to submit an affidavit either before or after receipt of final payment. In Tennessee, contractors must submit an affidavit to the owner upon receipt of final payment. This informs the owner of any outstanding amounts owing to subcontractors or vendors on the project.

Banks and financing companies may also request a final contractor’s affidavit when closing out the loan on a project. The GC will usually be required to complete the affidavit and return it to the bank to be added to the loan documents.

A contractor’s sworn statement provides similar information as an affidavit, but it’s usually submitted on a regular basis throughout the project. Most owners or financing companies will require a sworn statement with each invoice, which is usually on a monthly basis.

A sworn statement tracks the amounts owed and paid to subcontractors and vendors on a project as the project is progressing. It lists the contract amount for each sub or vendor, how much has been billed to date, how much has been paid to date, and the amount remaining on the contract. It helps assure the owner and bank that progress payments are being made.

A contractor’s affidavit, on the other hand, just states how much is owed to contractors and suppliers at the end of the project.

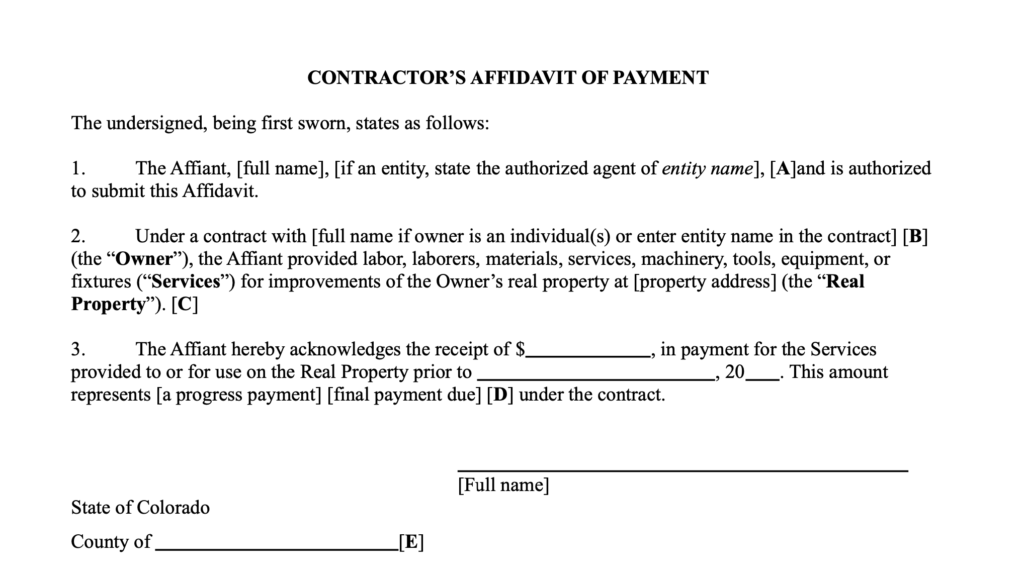

Construction attorney Robert Murillo gives some steps on exactly what should go in a contractor affidavit:

Insert the full name of the contractor or title of the person signing the template on behalf of the entity, including any trade name. This should be the same as in the contract. Review A in Notes on Use in the Affidavit of Payment template.

Then, insert the full name of the owner or owners or title of the person executing on behalf of the entity of the owner, including any trade name. Review B in Notes on Use in the Affidavit of Payment template.

Next, you enter the real property address. Review C in Notes on Use in the Affidavit of Payment template.

After that, you insert the amount of the payment. For final payment, some states, such as Florida, require a specified form of final payment affidavit so make sure to check the law of your state.

Finally, update the notary clause as required in your state. The sample affidavit relates to Colorado law so make sure to review your state law and update the notary clause. Do not sign the affidavit until you are before a notary.

It’s important to note that some states require a contractor’s affidavit and have a specific form that must be used to make the affidavit valid. Check the rules and regulations for the city and state you’re working in, so you know if a specific form is required.

Here are some examples of a contractor’s affidavit and templates you can use:

Here’s a general contractor’s affidavit form that can be used on any project. It was developed by construction attorney Robert Murillo.

The American Institute of Architects has a form that contractors can use, the G706 Contractor’s Affidavit of Payment of Debts and Claims.

It states that payment has been made in full for all materials and equipment furnished, labor, and services performed, and that there are no known claims other than those listed on the affidavit. The owner or bank may request or require supporting documents, including lien waivers, the AIA G707 Consent of Surety to Final Payment, or the G706A Contractor’s Affidavit of Release of Liens.

Florida requires that the final contractor’s affidavit be provided on a specific form. It must be sent to the project owner five days before filing a lien or a lawsuit. In addition, the owner is required to get an affidavit from the general contractor before making final payment.

Texas property code requires residential contractors to submit an affidavit of final payment to their customers upon receipt of final payment for a project. The affidavit must list all known unpaid amounts for the work performed on the project.

Tennessee requires contractors to submit a sworn affidavit to the project owner upon receipt of final payment. The form states that all debts related to the project, including those for extra work, have been paid in full. It also states that the contractor will protect the owner from any liens or lawsuits filed after the affidavit has been signed.

Contractors should always be careful when signing sworn affidavits, as these are legal documents that shouldn’t be taken lightly. Falsifying information on an affidavit is a criminal offense and is punishable by law.

Contractor affidavits protect project owners — and financing companies — reassuring them that all debts for the project have been paid. In some states, they must be sent to project owners before filing a lien or lawsuit for nonpayment, so make sure you know if this is the case in your state.