When taking out certain home equity lines of credit (HELOC), reverse mortgages, or mortgages on manufactured homes that aren’t attached to real estate, the Department of Housing and Urban Development (HUD) requires lenders to provide borrowers with a HUD-1 settlement statement.

A HUD-1 settlement statement, also referred to simply as a settlement statement, details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

If you’re getting ready to close on a conventional mortgage, you’ll typically review a closing disclosure. However, if you’re taking out a home equity line of credit (HELOC), a mortgage for a manufactured home that is not attached to real estate, or a reverse mortgage, you may be asked to review a HUD-1 settlement statement before heading to the closing table.

This HUD document summarizes the final details of your loan paperwork, and may also be accompanied by a Truth-in-Lending disclosure. Reviewing and understanding the contents of your HUD-1 settlement statement will help you avoid errors that could cost you time and/or money.

A HELOC is a mortgage-based line of credit that works much like a credit card. It allows you to pull from your home’s existing equity (or the value of the home that you own, compared to what you still owe to your lender) on a revolving basis.

Once approved for a HELOC, you can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as desired. This revolving product has a set draw period that usually ends after 10 years. After the HELOC draw period is over, you pay the remaining balance in fixed payments until it is paid in full.

Some home equity products are now exempt from using the HUD-1 settlement form, such as open-ended lines of credit. Your lender will let you know whether a HUD-1 settlement statement is involved, or if you’ll receive a Truth-in-Lending disclosure instead.

A reverse mortgage is a specialized type of mortgage for homeowners that are 62 or older. Rather than making payments to a lender, like with a traditional mortgage, a reverse mortgage allows you to draw from your home’s equity instead. You can get the funds in a lump sum, as monthly income, as a line of credit or a combination of all three.

Because no payment is being made, the balance of your reverse mortgage loan actually grows with time, rather than dropping. Your home equity will also decrease as the reverse mortgage goes on. Your reverse mortgage loan will need to be repaid either when you move out, the house is sold or upon your death.

Manufactured homes can be an affordable alternative to conventional homes built on a foundation. These manufactured homes are built in a factory, then transported and pieced together on land you may own or rent.

If the land is rented, or the manufactured home has not been affixed to the land on which it sits, the loan is treated differently. That’s because the home is considered personal property, much like if you were buying a car.

In this case, you may be provided with a HUD-1 settlement statement to go over your loan terms. This is different from the closing disclosure you would normally receive during the closing process on a manufactured home that is affixed and taxed as real property.

Some manufactured home borrowers may receive a Truth-in-Lending disclosure instead of a HUD-1 settlement statement or closing disclosure.

In the past, most borrowers received a HUD-1 settlement statement before closing. However, since October 2015, the majority of mortgage borrowers now receive closing disclosures rather than settlement statements. The Consumer Financial Protection Bureau (CFPB) introduced these disclosures as a way to more clearly deliver information similar to what’s in settlement statements.

Despite the change, however, not every borrower will get a closing disclosure. As mentioned above, borrowers taking out reverse mortgages, HELOCs or certain manufactured home loans will get HUD-1 settlement statements instead.

| HUD-1 settlement statement | Closing disclosure | |

| Who gets one | Borrowers with certain reverse mortgages, HELOCs or manufactured homes (not attached to real property) | Most other mortgage loan borrowers |

| What it contains | Summary of all loan charges and who owes what, including the property’s purchase price and fees | Summary of all loan charges and who owes what, including the property’s purchase price and fees |

| Readability | Three pages long; complex and can be difficult to decipher | Five pages long; a bit more simplified and clear to read |

| When it’s received | At closing, unless requested earlier | At least three business days before closing |

Settlement statements aren’t as easy to read as closing disclosures and don’t contain as much information. But that’s not the biggest problem with them: lenders don’t have to give you a settlement statement until the day of closing. If you want to see the document before closing, you’ll have to ask. In contrast, lenders must give you a closing disclosure at least three business days before closing.

If you are taking out a HELOC, reverse mortgage or manufactured home loan and will be receiving a HUD-1 statement, you should ask your lender for the document at least a day before closing. This allows you time to review the contents, fix errors and raise questions with the lender.

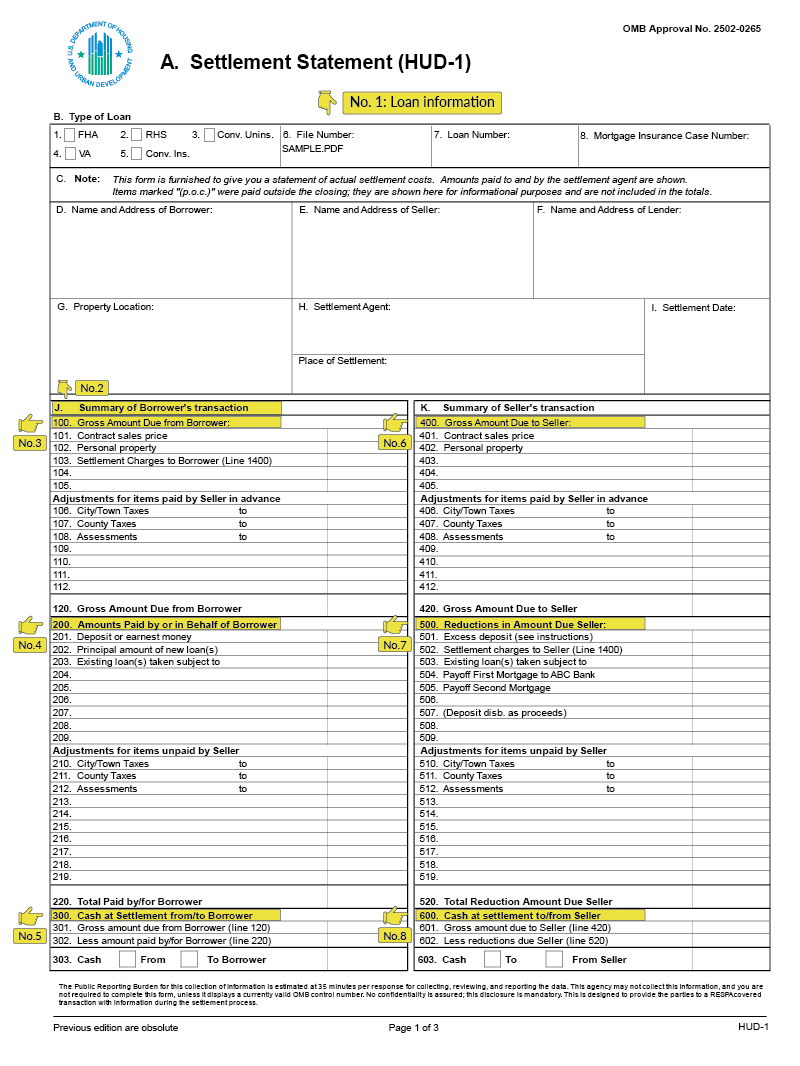

The HUD-1 form may seem overwhelming at first glance. The tiny print and weird jargon make it easy to ignore. However, it’s worthwhile to learn the basics. As an overview, this document looks like this:

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

At the top of Page 1, you’ll see basic information about your mortgage transaction, including what kind of loan you’re getting and who’s involved in the transaction. Double-check that everything is accurate, including the spelling of your name and the type of loan you’re taking out.

This section summarizes the details from Page 2 of the settlement statement. You’ll want to pay particular attention to Line 303, which explains how much money you need to bring to closing.

If this number is higher than you expected, you’ll want to discuss it with your loan officer before you sign your closing papers.

This section explains the amount you owe, including the property’s purchase price (if you’re buying a home) and any associated fees. You’ll find an itemized breakdown of all the fees contributing to this total on Page 2. Line 120 explains the total amount you owe.

This section details any credits you will receive toward costs you’ve already paid, or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

If the seller is paying closing costs, it should indicate “seller credit” or “seller paid costs” here. Line 220 will add up all the credits in this section.

This section lets you know if you need to bring cash to the settlement.

In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing. However, if you’re buying a manufactured home or using a reverse mortgage to purchase a home, you will likely need to bring cash to closing.

Line 303 explains the total cash you’ll bring to closing.

This section provides an accounting of the costs the seller is paying, including property tax assessments they will pay through the date that the sale is completed.

This reflects costs deducted from the seller’s proceeds, including any loans that are secured by the property and any other costs that need to be paid by the seller to complete the sale.

This is the total amount the seller will receive at closing. This section is only filled in if you’re buying a home.

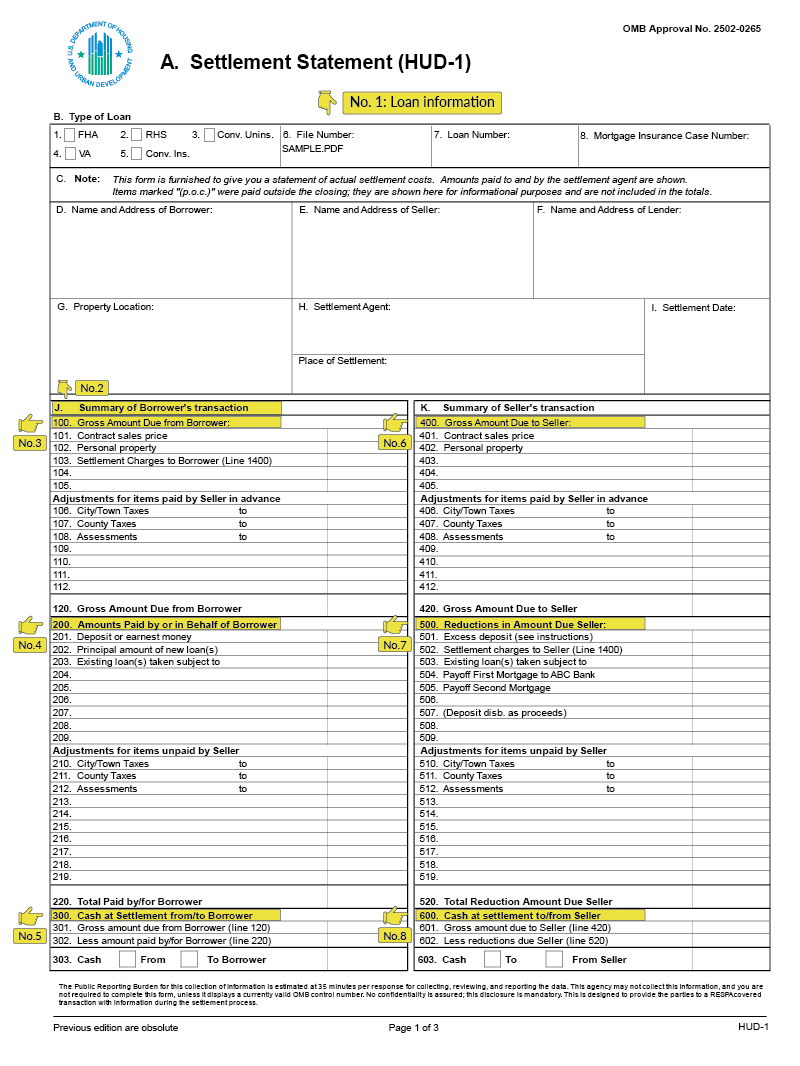

On the HUD-1, Page 2 spells out all the itemized charges associated with your loan and whether the buyer (you) or the seller will pay them. Check that you’re not paying fees that the seller or the lender agreed to pay.

Manufactured homebuyers may see entries in the seller’s section. In most cases, though, reverse mortgage and HELOC borrowers will only see data in the borrower’s section — unless a HELOC or reverse mortgage is being used for a purchase.

If real estate agents were involved in the transaction, the commission paid to them for their services is reflected here. The fee is often a percentage of the price you paid for the property.

Most loans have origination fees, points paid in advance (to reduce your interest rate) and various other fees. You will probably pay most of these fees at closing; if, however, you have paid a fee in advance, it will be marked “P.O.C.” in section 800, which means “paid outside of closing.”

Some people finance their closing costs when they’re taking out a reverse mortgage or HELOC. Even if you’re financing these costs, though, they will be outlined here.

Depending on when you close, you’ll pay some interest on the new loan you are taking out. The closer you are to the end of the month, the less your daily interest charge will be. Mortgage insurance premiums have to be collected at the closing, and your homeowners insurance premium will also need to be paid in advance so your home is insured at closing.

If you’re using an escrow account to pay for taxes or insurance, you’ll see upfront deposits listed in this section. HELOC and reverse mortgage borrowers are responsible for their own insurance and tax payments and shouldn’t see escrow deposits. However, if your closing date is around the time that property taxes are due in your area, you may end up having to pay the tax bill at closing.

Title charges are the costs of changing ownership, such as title examination fees and attorneys fees. You will pay title fees regardless of whether you are buying a home or refinancing it.

Lenders always require new title work to confirm that there are no new liens, judgments, or owners on your property that would impact the purchase. New title insurance will also be required on a refinance property, even though you purchased title insurance when you bought the home.

In general, you’ll need to pay for a new deed and for your city to record a new mortgage. The city, county and state taxes for these fees (as applicable) are noted in this section.

This section will have various charges related to pest inspections, lead-based paint testing, home warranties and other charges that haven’t yet been listed.

This section adds all the charges in Sections 700 through 1300. The total on this line should match Line 103 for borrowers and Line 502 for sellers (on Page 1).

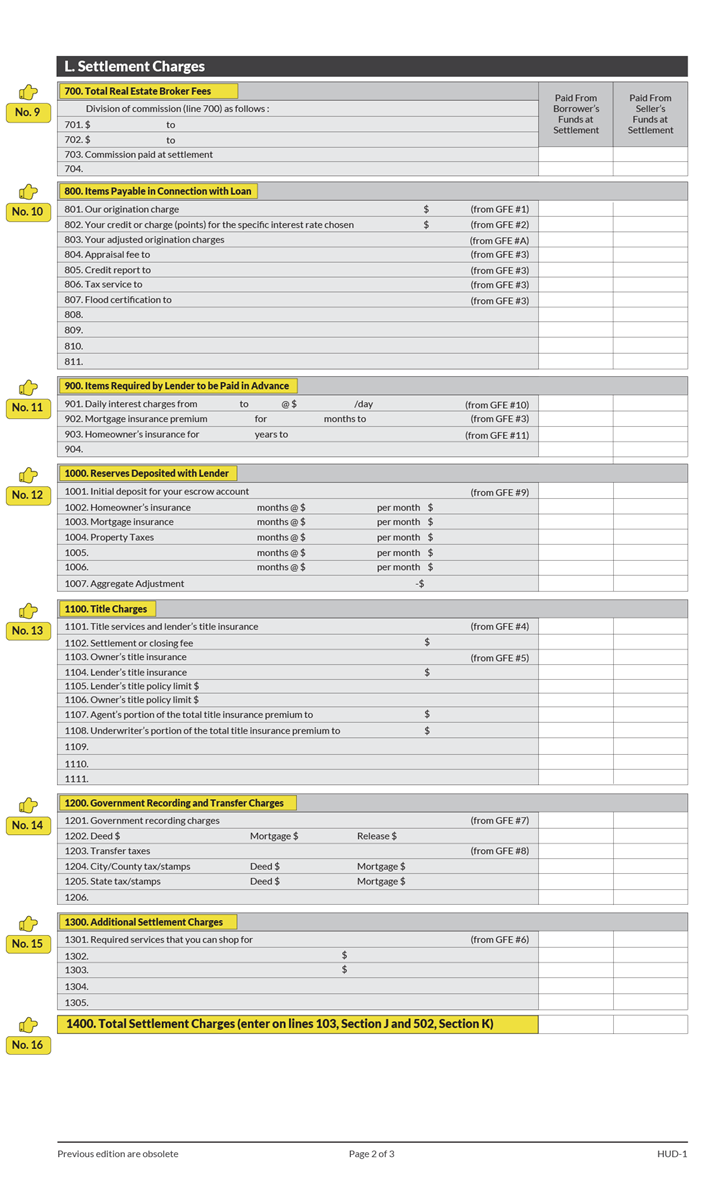

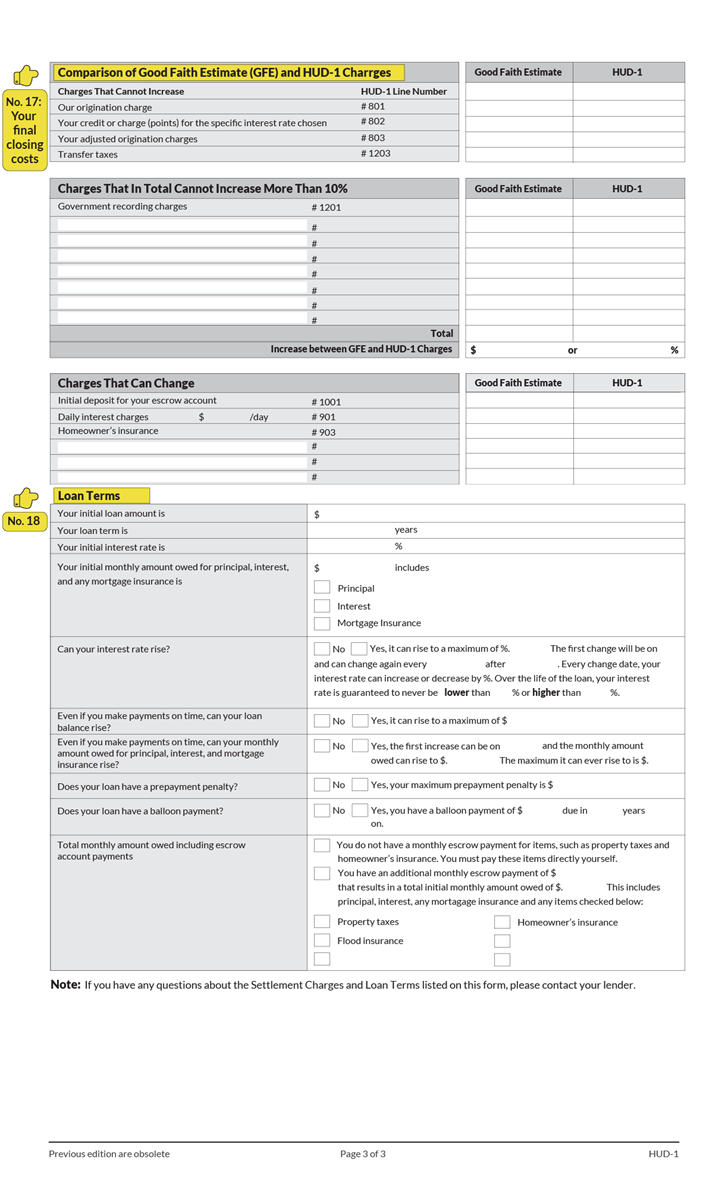

Page 3 compares your actual settlement charges and the charges listed in your Good Faith Estimate (GFE). The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

There may be valid reasons these fees end up higher or lower, and your lender will have to notify you within three days of the reason and provide you with an updated GFE reflecting the amount of the cost increases, so you have the opportunity to review them.

This section includes charges that cannot change as well as those that cannot change by more than 10%. If there is a difference between the amount listed in the Good Faith Estimate and the final amount on the HUD-1 document, these will be notated here.

In general, HELOC and reverse mortgage borrowers should not see many changes compared with the data in their GFE. You’ll want to ask your lender to explain any changes in this section.

The bottom of Page 3 in the HUD-1 document explains the details of your loan. Talk with your lender about anything that doesn’t make sense and continue asking questions until any issues are cleared up.

This section includes crucial information — for instance, how much your loan is, how long you’ll have it for and what the final interest rate is. It also notes your initial monthly payment, whether it can rise and the specifics of how your interest rate could rise. You’ll also see boxes about prepayment penalties and balloon payments.

Because these features can affect when you can pay off your loan, as well as how much your payments may increase with time, be sure you understand them.